One of the most significant cogs in a company's wheel is its finance department. Without expert finance professionals, a business cannot thrive or even sustain itself in a cut-throat competitive environment.

The only constant in today's business environment is technological change. While investing in up-and-coming technologies is an indispensable step to staying afloat, it's equally important to focus on your finance team's learning and development. Without an effective L&D program, businesses cannot fully leverage the new technologies they invest in.

Skill development of the financial workforce through L&D is pivotal for an organization's success. According to Statista, the average annual L&D expenditure per employee sits at $1,308 (as of February 2022). However, there is a considerable gap between the training demands of employees and what's actually delivered.

For most businesses, the time constraints, cost of set-up, and the reluctance of managers to prioritize learning and development continue to hinder the growth of employees and the organization overall.

Why Do Finance Professionals Need an L&D Program?

Listed below are the primary reasons why finance professionals need an L&D program:

- Changes in regulatory policies: Learning and development allow finance professionals to stay updated with regulatory changes. This, in turn, allows your business to remain compliant.

Reskilling and upskilling: Traditional L&D programs for finance professionals were synonymous with compliance training. However, this no longer is the case. Your finance workforce requires new technical and soft skills to achieve their professional development and use their newly-acquired expertise for your company's betterment.

Technical Skills

A 2021 study by Gartner revealed that the pandemic prompted 69% of finance firms' directors to expedite their digital initiatives. The image below shows where the priorities of FP&A leaders lie as far as technology is concerned.

Financial planning heads and chief financial officers (CFOs) are investing in these major areas of technology to improve their workflow:

- Artificial intelligence (AI)

- Robotic process automation (RPA)

- Machine learning (ML)

- Advanced data analytics

With this tremendous focus on technology, it's vital to reskill and upskill finance professionals. Take financial analysts, for example. They need appropriate data literacy skills to extract and assess financial data.

Without this skill, it's not possible to make well-informed decisions. Hence, creating an L&D program for finance professionals should be a priority for businesses.

Soft Skills

It's not just the technical skills that your finance workforce needs an L&D program for.

As per another report, they also require the following soft skills to perform their best:

- Problem-solving skills

- Communication skills

- Creativity

These skills are even more critical in the age of automation. Everything that can be automated will be automated in the finance realm. So far, AI can't think for itself like conscious human beings.

Creativity, problem-solving, and other soft skills will aid finance professionals in using AI as helpful assistants. Besides, they can neither share their ideas nor interact with their teammates effectively without excellent communication skills.

With the advent of remote and hybrid teams, soft skills like collaboration, communication, and empathy are pivotal for success.

Types of L&D Methods for Finance Professionals

Now that the need for developing an L&D program for finance teams has been identified, this section will cover the types of learning and development methods that you can approach.

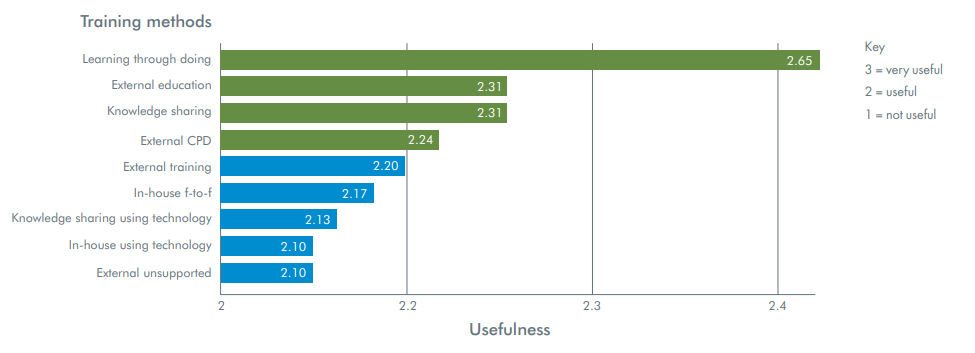

A study conducted by the Chartered Global Management Accountant (CGMA) identified that 'learning through doing is the most effective L&D method for finance teams. It's also the most widely used learning and development method.

Refer to the image above. The L&D methods in green were considered useful in the survey, while the ones in blue were not regarded as beneficial. However, with changing times, perceptions also change.

Implementing an L&D program through in-house technologies is just as important now. Blended learning, a combination of online learning (such as distance learning through the internet) and traditional learning (such as seminars), is one example of in-house technologies.

Listed below are the most popular methods that you can incorporate in your L&D program for finance personnel:

1. Learning Through Doing

Also known as experiential learning, this method has been used for a long time. Take swimming, for example. No matter how much you read about it, you cannot learn to swim without getting into a pool and performing the action.

This is what experiential learning is all about. Instead of passively learning about new skills, how about taking the proactive approach? It's possible to make mistakes while learning through doing. However, this L&D method allows finance employees to learn from those mistakes.

These are the various forms of learning through doing:

- Secondments: This L&D method provides a phenomenal learning opportunity. Secondment is when an employee is temporarily assigned to a different team in the same company or even in a different company altogether. Think of it as an exchange program but instead of college, it happens in the corporate world.

- Colocation: In colocation, the members of a project team are required to be in the same physical location where they also have access to all the necessary resources. This learning while doing method aims to foster productivity and collaboration.

- Job Rotation: This method is especially useful if you wish to improve the business acumen of finance professionals. Let's say you want to promote an employee to a senior finance position. But before that, they need to have an in-depth understanding of how the company operates and how it affects the bottom line. You can temporarily transfer that employee to a senior-level position using job rotation. It would help them master new skills, such as big-picture thinking and problem-solving. Besides, job rotation works wonders for your employee retention efforts.

- Mentorship: Including mentorship in your L&D program is crucial. Allow your senior-level finance personnel to guide young colleagues and share their experiences with them. Let them work on projects together so that less-seasoned finance professionals can gain valuable insights from their mentor's experiences.

2. External Training Courses

Skills that don't necessarily require on-the-job learning can also be acquired through short one-off courses. For this, you can partner with a vendor who can create these short courses for your finance team.

The importance of L&D can be stated in the fact even during the pandemic, the training expenditure in the United States increased by 12% between 2020 and 2021.

3. Continuing Professional Development (CPD)

Many organizations support the professional qualification requirements of their employees as part of their continuing professional development (CPD) initiative. That could be an MBA degree or any degree that can help finance professionals advance their careers and at the same time contribute to the company's success.

However, many would argue that most companies hire fully-qualified finance professionals instead of spending resources on their education. Moreover, the degree courses are not attuned to the organization's specific needs. This L&D method is more useful for non-senior finance professionals.

Hence, this is something you may consider for your L&D program.

4. In-House Training

Hiring fully-qualified finance professionals do not mean that you don't need to create an L&D program. As mentioned earlier, there are always new skills and competencies in demand due to rapid technological changes.

However, if supporting external training is something you find too time-consuming (or even expensive in some cases), you can always bring the training in-house. Large organizations can especially benefit from this method because their L&D cost per head reduces, thanks to their economies of scale.

However, smaller organizations may lack the resources and agility to implement in-house training. An affordable vendor who can develop training modules is the best option for them.

These are the types of in-house training you may consider for your L&D program:

- Face-to-face learning: It involves more conventional L&D methods, such as seminars and lectures.

- Blended learning: It's a combination of online and conventional learning. As many employees continue to work remotely, blended learning has become critical.

- Peer-to-peer learning: Using employee-led workshops (in-house or virtual), you can encourage knowledge sharing in your organization, including the finance department. Peer-to-peer (P2P) learning allows employees with beneficial skills to share their expertise with their colleagues.

Tips on Creating the Best L&D Program

What makes an L&D program impactful?

Experts suggest that "An effective learning and development program addresses the needs of today but also those of the future."

Newly gained skills allow finance professionals to perform their best every day. But they also prepare them for more technological changes in the future.

Listed below are the essential tips that would help you develop a successful learning and development program for your finance team:

1. Conduct an Employee Survey

Employee surveys are essential for many reasons. First, they help you determine the exact learning needs of your finance staff. Second, they help you establish goals for the L&D program. And third, they allow employees to provide feedback on the same.

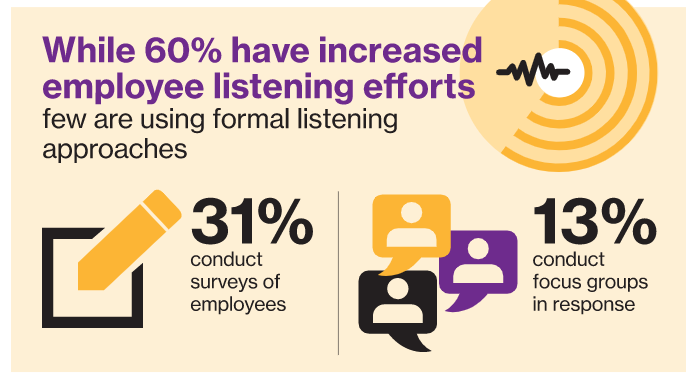

Without these, you'll be spending more money but reaching nowhere. Unfortunately, according to a survey by Willis Towers Watson, only 31% of organizations leverage employee surveys.

Though it's an increase compared to pre-pandemic times, there's a clear need to ensure that your employees feel heard and valued - especially when there's an L&D program in question.

2. Modernize Your L&D Program

While developing an L&D program for finance professionals, it's important to focus on both flexibility and innovation. Modern L&D approaches, such as mobile learning and microlearning, facilitate that flexibility. Besides, they improve the engagement and accessibility of training content across devices.

That said, you don't need to abandon traditional learning methods (like seminars) altogether. You'll benefit more by taking the hybrid route and using both innovative and conventional L&D methods. If creating bite-sized, engaging training content isn't your forte, consider outsourcing this job to an e-learning course developer.

3. Focus on Customer Experience

Enhancing your customer experience is a sure-fire way of outshining your competitors and gaining a majority share in the market. Your L&D efforts, therefore, should also be directed towards improving the customer experience, especially if a particular role requires direct communication with the customers.

Again, soft skills play a major role here. Did you know that excellent customer service can boost your revenue by 4-8%? This was found in a 2021 study by HubSpot.

According to the study, there are two forms of customer service, as shown in the image below:

If you aim to become an industry frontrunner, you must adopt a proactive customer service approach. In this approach, you predict the problems that your existing or potential customers may encounter in the near future. Next, you devise strategies to eliminate those problems beforehand.

This brings us to our final tip!

4. Foster an Agile Culture

Creating an L&D program is not a one-and-done thing. To ensure continuous improvement of your finance employees, make sure you upgrade the program from time to time. But doing so requires your company to be agile and flexible. This way, you can quickly respond to regulatory, technological, and industry changes.

With time, you will develop resilient finance employees who can withstand any storm in the future. For almost 59% of organizations, their existing culture continues to be a significant hurdle towards attaining agility. This was found in the 2019 Global Agile Survey by KPMG.

Hence, the C-suite must encourage an agile culture to allow that to happen.

To Sum Up

Creating an effective L&D program for finance professionals is essential for upgrading their technical skills and soft skills. There are various learning methods you can incorporate, including learning through doing, external training courses, continuing professional development, and in-house training.

It's not obligatory to stick with just one L&D method. Instead, you can choose a variety of approaches that best support your long-term goals. Follow the tips on creating a successful L&D program mentioned in this article, including conducting a survey, modernizing your program, improving customer experience, and promoting an agile culture, to start.

Remember, learning and development do incur time and resources. But it's truly an investment, not an outlay. After all, your training efforts will provide lucrative returns in the future.